Financial Services

Financial Services Key Themes

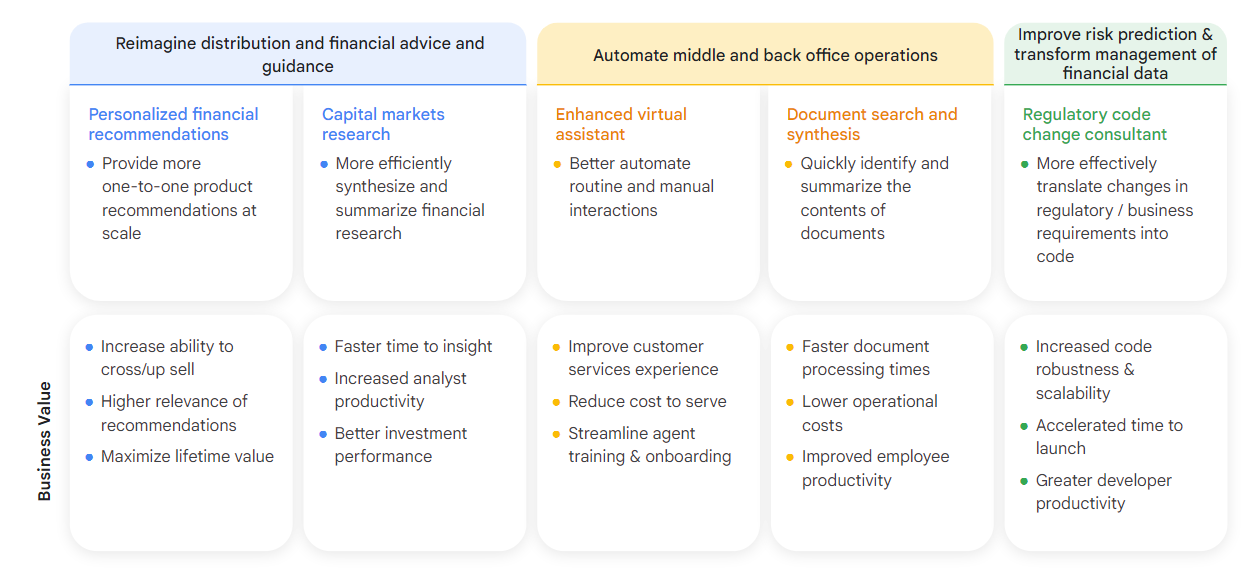

Top Use Cases for Financial Services

Financial Services Solution Areas

Customer Support

Incorporate AI into your financial services sales and support operations to catalyze a revolution in customer engagement. Elevate your digital presence by harnessing the power of AI-driven analytics to understand customer preferences and behaviors deeply.

By leveraging advanced algorithms, offer personalized product and service recommendations tailored to each individual's needs and aspirations. This proactive approach not only fosters stronger customer relationships but also drives enhanced satisfaction and loyalty.

Embracing AI in sales and support transforms traditional processes into dynamic, customer-centric experiences, setting the stage for sustained growth and success in the ever-evolving financial landscape.

Underwriting Risk Management

Implementing AI for underwriting processes brings about a transformative leap in efficiency and accuracy. By leveraging machine learning algorithms, automated document processing becomes seamless, reducing manual errors and saving valuable time.

Furthermore, AI-driven risk assessment tools provide comprehensive insights, enabling faster decision-making while ensuring robust risk management. This integration not only streamlines operations but also enhances overall underwriting effectiveness, leading to better outcomes for both clients and financial institutions.

Operations

For financial services firms, the integration of AI offers a transformative pathway to optimizing day-to-day operations and elevating the customer experience. Through cognitive document processing, AI technologies streamline cumbersome administrative tasks, such as document verification and data entry, leading to significant time and cost savings. Moreover, the implementation of smart-assist bots enhances customer service by providing real-time assistance and guidance, whether it's answering inquiries, resolving issues, or offering personalized recommendations.

By leveraging these AI-driven solutions, financial institutions can not only boost operational efficiency but also cultivate stronger customer relationships, ultimately driving sustainable growth and competitiveness in the market.

Insurance Claims Processing

AI presents a game-changing opportunity for optimizing claims processing within the insurance industry. By leveraging advanced machine learning algorithms and natural language processing capabilities, insurers can streamline the entire claims lifecycle, from initial submission to final settlement. Through AI-powered automation, routine tasks such as data extraction from claim forms, assessment of damage, and validation of policy coverage can be expedited with greater accuracy and efficiency. Moreover, predictive analytics models can flag potentially fraudulent claims early on, enabling prompt investigation and mitigation of risks.

Additionally, AI-driven chatbots and virtual assistants can provide round-the-clock support to claimants, offering instant updates on claim status and guiding them through the process seamlessly. By harnessing the capabilities of AI in claims processing, insurers can enhance operational efficiency, reduce costs, and deliver a superior customer experience, ultimately fostering trust and loyalty among policyholders.